The home of carbon market data: where innovation drives intelligence

Transparency and Market Intelligence For the Voluntary Carbon Market. Tracking every project, buyer, and trend across global registries.

AlliedOffsets’ Corporate Buyers Report

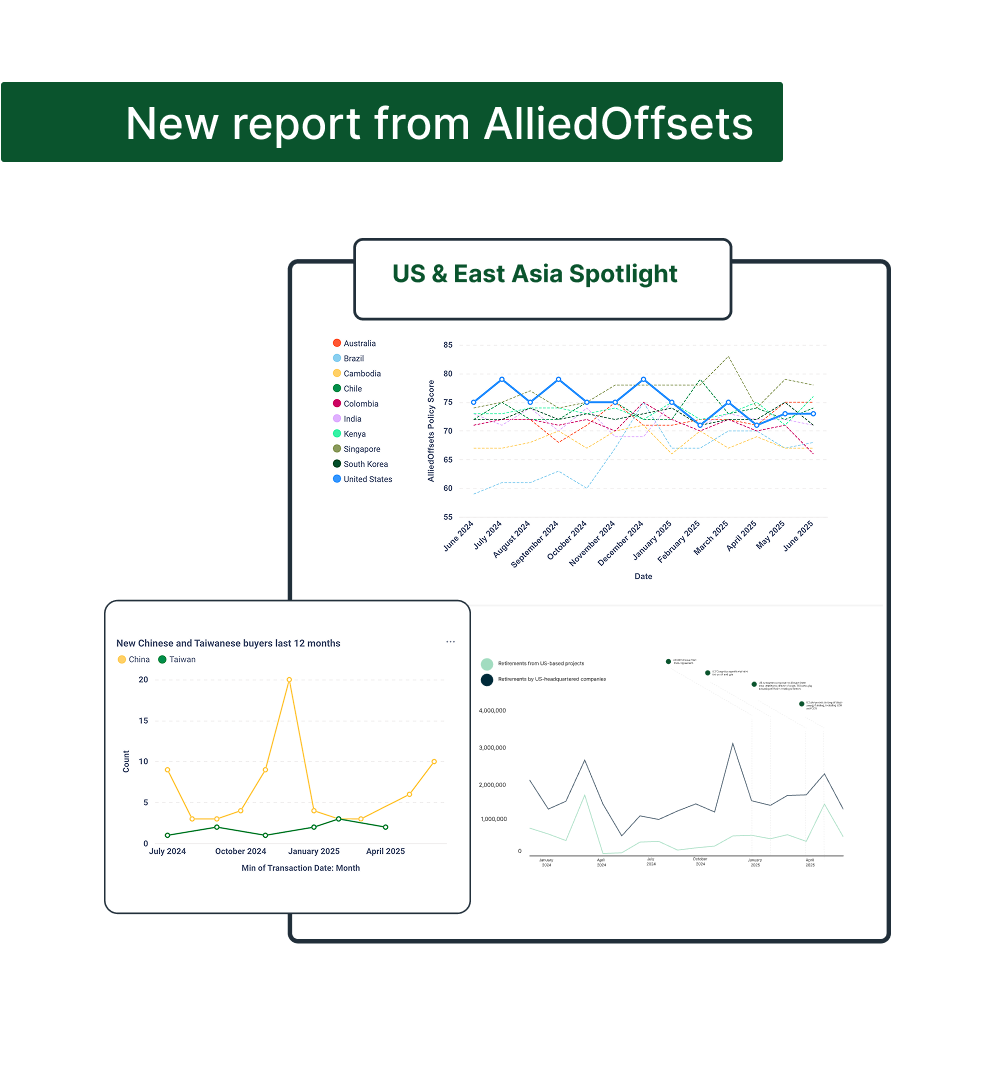

This report provides a comprehensive overview of carbon market activity from the first six months of 2025, drawing on AlliedOffsets corporate buyer dataset to explore who is buying, what they’re buying, and what their motivations are.

We examine buyer motivations and patterns across sectors and geographies, and we also assess how policy developments are influencing corporate decisions around offsetting and climate finance.

Download

Our Data

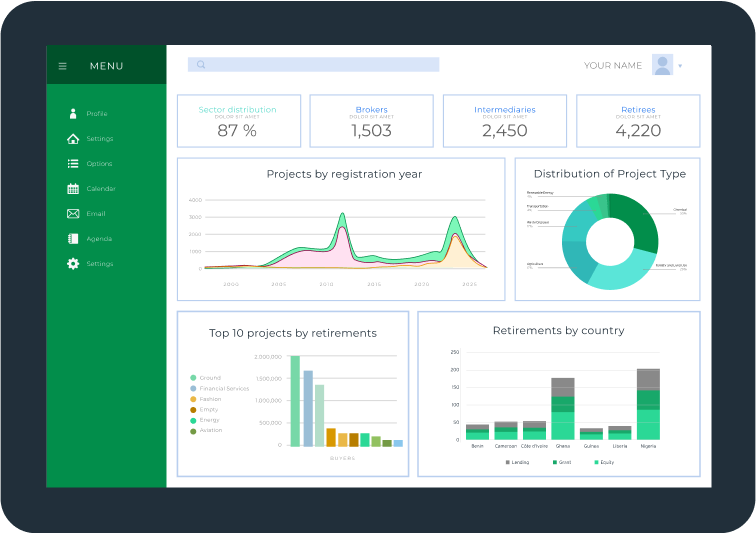

AlliedOffsets provides advanced analytics, forecasting, and benchmarking tools built on the most comprehensive carbon market dataset.

Our platform covers current market activity and forecasts future trends in the voluntary carbon market.

This data is updated on a regular basis, allowing investors, researchers, consultants, brokers, marketplaces, and others to conduct bespoke, in-depth analysis on the carbon markets. Explore some of our data from our dashboard below!

35248

projects

971

CDR companies

17915

corporate buyer profiles

Our Solutions

We offer a number of different solutions to fit your unique carbon data needs. This includes a data dashboard for voluntary carbon market activity, an API for data scientists and developers, AI tools for processing project documents, and much more!

Who We Work With

Project Developers

Track latest prices for your credits, find buyers and brokers, and conduct competitor analysis.

Consultants

Identify market trends in purchases, pricing, and policy developments.

Brokers & Traders

Find buyers and identify eligible compliance schemes for credits in your portfolio.

Corporates

Uncover credits that match your needs and keep up with latest policy developments.

Financial Institutions

Get the data you need to find an edge and make sound investment and trading decisions.

Academics & Researchers

Conduct in-depth research on pricing trends and carbon market impact on a global scale.